This is the third article in the Native Chronicles series, brought to you with the support of TripleLift. Read the first article on the “creative revival,” and the second on flexibility and A/B testing.

For a long time, you could not go to a conference on advertising technology without hearing mention of venture capitalist Mary Meeker’s infamous attention gap: while Americans were spending more time on the Internet, TV advertising drew far more revenue.

So why does IPG Mediabrand’s report that total global ad spend on digital channels broached $208 billion in 2017—topping TV’s measly $178 billion or 35% of the ad marketplace—taste bittersweet at best? Shouldn’t we be cheering because finally the gap has closed!

Yet I don’t feel like cracking open the champagne because a new attention gap—one that Meeker has been highly focused on for the last few years—has developed within digital: more money is being spent on desktop advertising although users are devoting increasing amounts of time to their mobile devices.

There are a lot of similarities between the TV-digital gap and the desktop-mobile gap. Notably, how users engage with content (including advertising) on the platforms is wildly different, even when it’s the same content across channels. Beyond that, the industry has been flummoxed finding effective, revenue-driving advertising formats for mobile… That are easy to produce and execute. (Arguably, we’re still looking for this in desktop!)

It’s not that advertisers don’t want to reach consumers where they spend the most time—advertisers want to reach consumers through pleasing or at least innocuous formats at scale… and at a decent price point. Who is going to pay an $80 CPM for an ugly banner a user will scroll right past?

Which is why there’s hope—according to eMarketer, brands are expected to increase spend in non-social native by 44% to $5 billion in 2018. And getting those component-based native units flowing through the programmatic pipes is going to be key in shrinking the desktop-mobile attention gap.

Creative Blocks

Mobile monetization has been a bear for publishers and app-makers since the iPhone first appeared 10 years ago. Less screen real estate means bombarding users with banners isn’t an option (and shouldn’t be…). Pubs have experimented with sticky sliver or frozen units much to their audiences’ ire—the importance of user experience in mobile monetization is tenfold that of desktop.

On mobile networks, you have to weigh concerns about data usage and load times that high-speed desktop Internet connections render relatively irrelevant. In 2016, Meeker commented that mobile advertising was stuck in conservative display territory, but data usage and latency issues (potentially aggravated by transacting programmatically) have been a huge hurdle to ad unit creativity.

Which is why native advertising has been such a breakthrough. These units are lightweight and can load fast, and then offer harmony with their surrounding content by sharing design characteristics.

No Interruption to Pardon

Truth be told, it took a while for publishers to figure out the best designs for presenting their wares on mobile devices (and you can easily argue many pubs are still struggling), but it’s now clear the optimal home for ads is in-feed. This ain’t your pappy’s newspaper with its adjacent advertising!

Taking that idea further, why should the ads seem intrusive—like they’ve been haphazardly smacked into the middle of the feed? Pubs have taken a cue from social networks—which have flourished in the mobile space—and embraced ads that match site design aesthetics in a dynamic fashion.

The onus of creativity is placed on the messaging rather than the format. As I suggested with the New Dichotomy, this frees creative types to focus on high-impact but labor-intensive sponsored content campaigns (and native advertising may drive traffic to these more salient campaigns).

Programmatic Paths

But there’s another twist to the mobile monetization trouble—in the early days of mobile display, lack of measurement capabilities kept direct sales limited. So publishers turned to ad networks and the nascent mobile programmatic pipes, which unfortunately drove down mobile inventory prices.

There is a silver lining—AdMonsters has long believed programmatic would reign large in mobile because of the targeting potential of location data and IDs based on device graphs. Yes, it’s the most personal of all devices, so it makes sense that targeted advertising would be far more effective and popular than run-of-site.

Imagine a format that’s lightweight and non-interruptive zooming through programmatic pipes, fueled by ever-powerful and personal mobile data? The potential is off the charts.

eMarketer came to a very similar conclusion in its report: “As publishers redesign their content experiences for a mobile-first world, enabling programmatic access to in-feed or in-article ads is becoming a no-brainer for those looking to offer buyers more of their higher-value inventory.”

Ride the Growth Curve

It’s also worth noting, though, that the same report suggests that advertisers will spend around $28.24 billion on native altogether in 2018—that’s more than $23 billion for social native on networks like Facebook.

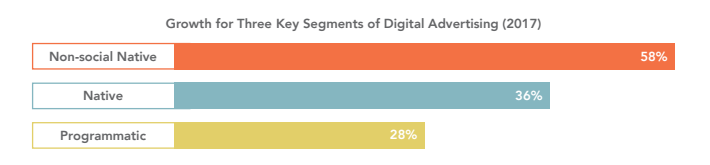

Facebook continuing to dominate mobile in 2018 won’t even surprise the most casual of mobile observers. But take a look at the growth rate for non-social native vs. overall native in 2017, presented in handy graph form thanks to a TripleLift whitepaper.

Non-social native has a higher velocity precisely because of the programmatic channels. Since the company closed its FBX exchange, advertisers have less control over ad targeting on Facebook compared to non-social inventory.

Obviously, advertiser’s enthusiastic spend on social native shows they like the format, but now they want the targeting command they have long enjoyed with desktop (and mobile) programmatic. It doesn’t hurt that advertisers are appearing on the mobile websites and apps of their trusted premium publisher partners, waylaying the ever-present brand safety woes.

The growth curve is on publishers’ side, but drawing that extra spend is a team effort. Not only do publishers need to ensure their readiness, they need to demand their tech partners support native component-based advertising. They might even have to apply pressure by lowering the priority of programmatic partners that don’t support native.

A drastic move, sure, but progress rarely yields for the non-compliant. Not only is native set to contract the gap between desktop and mobile for publishers, it’s quickly establishing itself as the future of display creative.

More articles in the Native Chronicles series: