|

||||||||||||

|

||||||||||||

| MediaMath's Surprise Resurrection: Infillion Purchases the DSP for $22 Million |

|

| MediaMath filed for Chapter 11 bankruptcy only a couple of months ago and sent the ad tech industry reeling from its loss. Shocked Ad Ops professionals wrote condolences for the beloved DSP, but the major worry was the $100 million debt left behind for their publisher and SSP partners. Unfortunately, the industry consensus was that most of the debt would fall on publishers' backs except for a few use cases. Does this purchase change the game? Infillion and Beyond: In an auction to purchase MediaMath, Infillion emerged as the highest bidder with a whopping $22 million bid. According to Business Insider, Infillion plans to restore the DSP, recruit former MediaMath employees, and seek out former clients such as Macy's, Sanofi, and Staples. On August 23, a Delaware bankruptcy judge approved the purchase, and in a transcript of the auction, Infillion founder and executive chairman Rob Emrich sounded optimistic about his investment. He projects that the "MediaMath purchase will remit $1 billion in inventory traffic, data fees, and hosting contracts over the next five years." The question remains whether Infillion can handle MediaMath's responsibilities in the ad tech ecosystem. Infillion launched in 2022 after Disney sold its video ad tech asset, TrueX, to Gimbal. They offer a range of solutions, such as campaign planning and media buying through shoppable video, data, and measurement tools. Their clients have included Amazon, Bank of America and T-Mobile. After its 16-year tenure, MediaMath struggled to keep up with competitors like The Trade Desk, but their bankruptcy left a noticeable hole in the ecosystem. Infillion has big shoes to fill. |

| While the purchase has the ecosystem in good spirits, ad ops professionals still wonder what this means for sequential liability. Marc Boswell, Chief Revenue Officer at LoveToKnow Media, asserts, "This is good, but hopefully, the majority of the debts will get paid now, and publishers won't be left with clawbacks." Infillion has yet to publicly announce how it will handle the debt and clawbacks, but the industry has a shaky history with the process. In lieu of MediaMath's initial bankruptcy announcement in June, AdExchanger reported that several SSPs leaned on sequential liability clauses in their contracts to claw back the money from publishers. While SSPs with sequential liability have every right to do this, the industry does not widely support the strategy. Infillion’s Sequential Liability is still in limbo, the industry will watch as they attempt to take MediaMath's legacy and build upon it. Justin Wohl, Chief Revenue Officer at Salon, maintains that Infillion's resurrection of MediaMath will ensure continued healthy competition amongst DSPs, which he considers a victory. "It will be interesting to see how well Infillion successfully wins back those advertisers who were forced to relocate to other DSPs rapidly," said Wohl. "They should certainly be able to create compelling opportunities for their existing clientele to bring budget onto MediaMath." MediaMath struggled, in the end, to differentiate themselves in an oversaturated and bloated supply chain, which is why they ultimately had to file for bankruptcy. While Infillion has experience working with significant clientele in the ad tech space, they have taken on a massive responsibility in the bidding process. "They've got an uphill climb if they want to reinvent the company. First, they need to earn back the trust of their former clients, and secondly, they'll need to work hard on differentiating themselves, which is what got them in trouble in the first place," said Boswell. |

|

| When a $170 Million Fine Isn’t Enough to Learn a Lesson |

| The News: Children advocacy groups — including Fairplay, the Center for Digital Democracy (CDD), and Electronic Privacy Information Center (EPIC) — sent a letter to the FTC asking it to investigate YouTube’s data and advertising practices. The Background: The letter is in response to research published by Adalytics which shows that ads selling things like cars and financial services (in other words, ads meant for adults) actually targeted kids watching YouTube videos geared towards kids. Those campaigns, executed using Google’s own tools, supported features like tracking users who clicked on the link and visited the advertiser’s website. According to Adalytics, over 300 brand ads reached kids on nearly 100 YouTube kid-oriented videos. Some of those ads included “violent content and images, including explosions, sniper rifles, and car accidents.” The Law: In 1998, Congress passed the Children Online Privacy Protection Act (COPPA) to curb the rampant growth of marketing techniques that target kids, such as branded games. At the time, numerous websites were collecting personal data of these kids and using it for advertising purposes without parental knowledge or consent. The primary goal of COPPA is to enable parents to control what information is collected about their children aged 13 and younger when they go online. The Previous $170 Million Fine. In September 2019, the FTC fined Google $170 million for “collecting personal information—in the form of persistent identifiers that are used to track users across the Internet—from viewers of child-directed channels, without first notifying parents and getting their consent.” “YouTube touted its popularity with children to prospective corporate clients,” said then FTC Chairman Joe Simons. “Yet when it came to complying with COPPA, the company refused to acknowledge that portions of its platform were clearly directed to kids. There’s no excuse for YouTube’s violations of the law.” At the time, the $170 million was the largest COPPA fine in history. So what was Google thinking in not locking this stuff down? |

| Trust is an essential element of advertising. All consumers want assurance they won’t be harmed by the ads they see, including protecting their privacy. Parents are particularly concerned about their children’s privacy and brands that track their online interactions. Stories like these tell parents that they can’t trust the ecosystem to do right by their kids, which is a detriment to everyone involved in trading inventory and placing ads. |

| The New York Times Weighing Legal Options Against OpenAI |

| The News: According to NPR, the New York Times is considering a lawsuit against OpenAI for violating its intellectual property rights. The two companies have been discussing but failed to agree on an appropriate level of compensation for New York Times articles incorporated into ChatGPT training and responses. The Background: OpenAI has trained its large language model (LLM) on the open internet, which includes publications like The New York Times. “The unlicensed use of content created by our companies and journalists by GAI systems is an intellectual property infringement: GAI systems are using proprietary content without permission,” wrote the News / Media Alliance back in April when it introduced its AI principles. At issue, a user can ask ChatGPT to write an article on a topic, which the user then sells to another publication as original content. But some of those ideas may have originated from another journalist and publication, who aren’t compensated or credited for their efforts. |

| Around the Water Cooler |

|

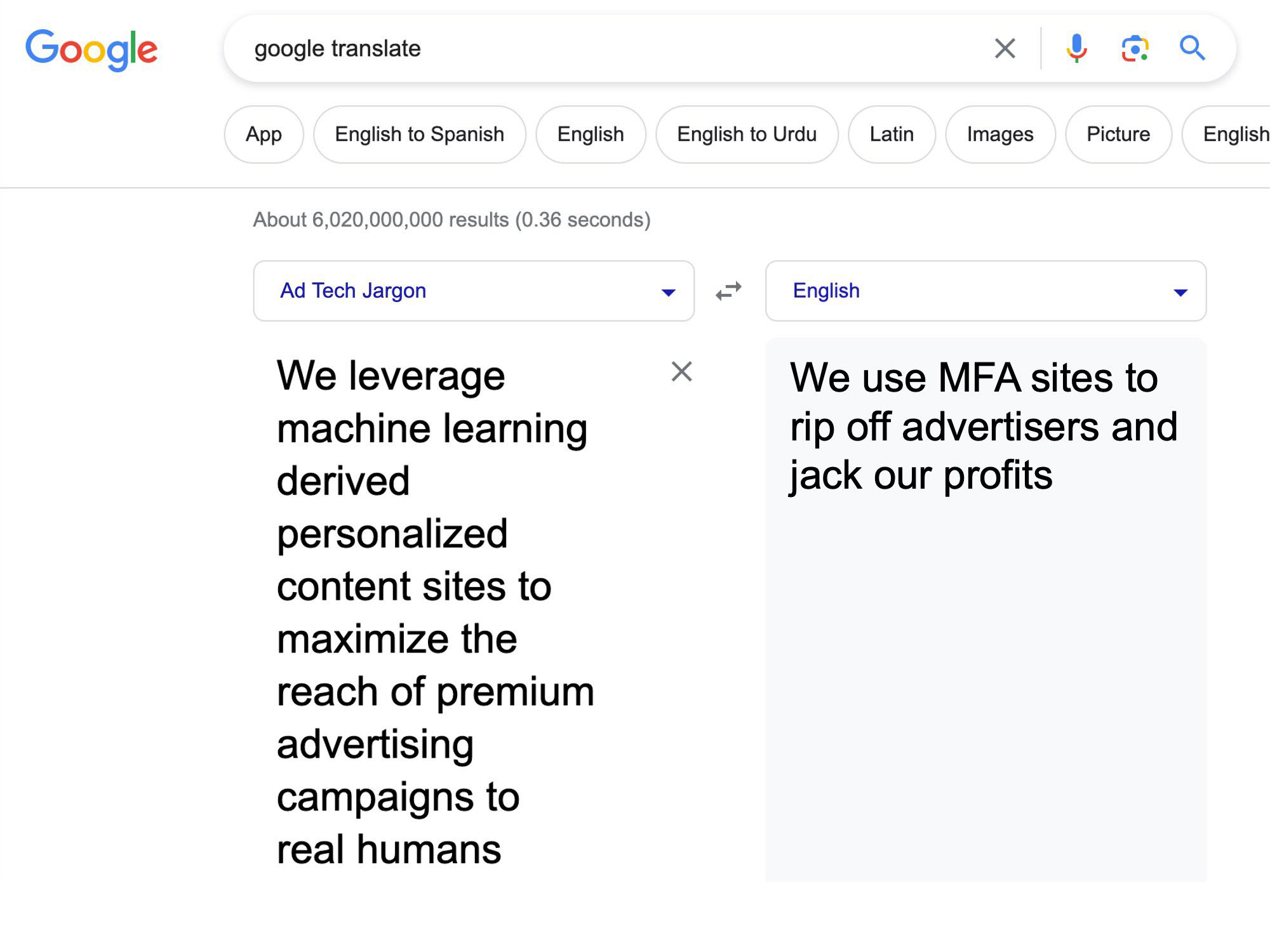

| TTD Set to Undercut Publshers’ Ad Prices In the latest Insider ad tech scoop by Lauren Johnson, “The Trade Desk will start undercutting the fees publisher adtech firms tack on to digital ads.” Sound like big news and another race to the bottom? We thought so too. But then here comes ad tech Twitter (we mean X) making sense of it all. While TTD will ignore floor prices if they think they are set too high, publishers will still be able to ignore those lower bids. (Insider) GroupM Announces Removal of MFAs from Inclusion Lists GroupM has taken a significant step by removing Media-Focused Advertisers (MFAs) from its inclusion lists. This strategic move reflects GroupM's commitment to refining media buying practices, enhancing brand safety, and embracing a more precise and effective targeting approach in the ever-evolving landscape of digital advertising. (Digiday) Musk Removal of News Headlines on X Ignites Backlash from Journalists Elon Musk's decision to remove news headlines from platform X has sparked outrage among journalists and media circles. This unexpected move has ignited a debate on the balance between editorial control and freedom of information in the digital age. (Media Post) How Publishers Can Help Advertising's Challenge of Addressability The issue of addressability poses a significant hurdle for the advertising industry, but a potential solution lies in the hands of publishers. (Digital Content Next) |