The state of programmatic advertising placing digital as king signals a mixed bag of data investment and falls prey to privacy.

According to a webinar hosted by Comscore, 2023 State of Programmatic, programmatic spend has experienced exponential growth, doubling over the past four years. Data shows that over 91% of $148 billion in digital display dollars are transacted programmatically. Where does this leave the state of programmatic?

The short answer is that the automated supply chain is flourishing, but signs indicate an ad spend slowdown. The further context suggests that since programmatic accounts for nine out of ten digital ad dollars, the market is reaching a state of saturation rather than stagnation.

On the other hand, these statistics only apply to display advertising. Mediums such as CTV, video, mobile, and audio utilize the programmatic supply chain to buy and sell ads. But we don’t have to tell our readers that programmatic touches almost every side of digital advertising.

To get to the bottom of programmatic in 2023, Proximix by Comscore surveyed industry professionals about how they perceive programmatic advertising outside of what headlines suggest.

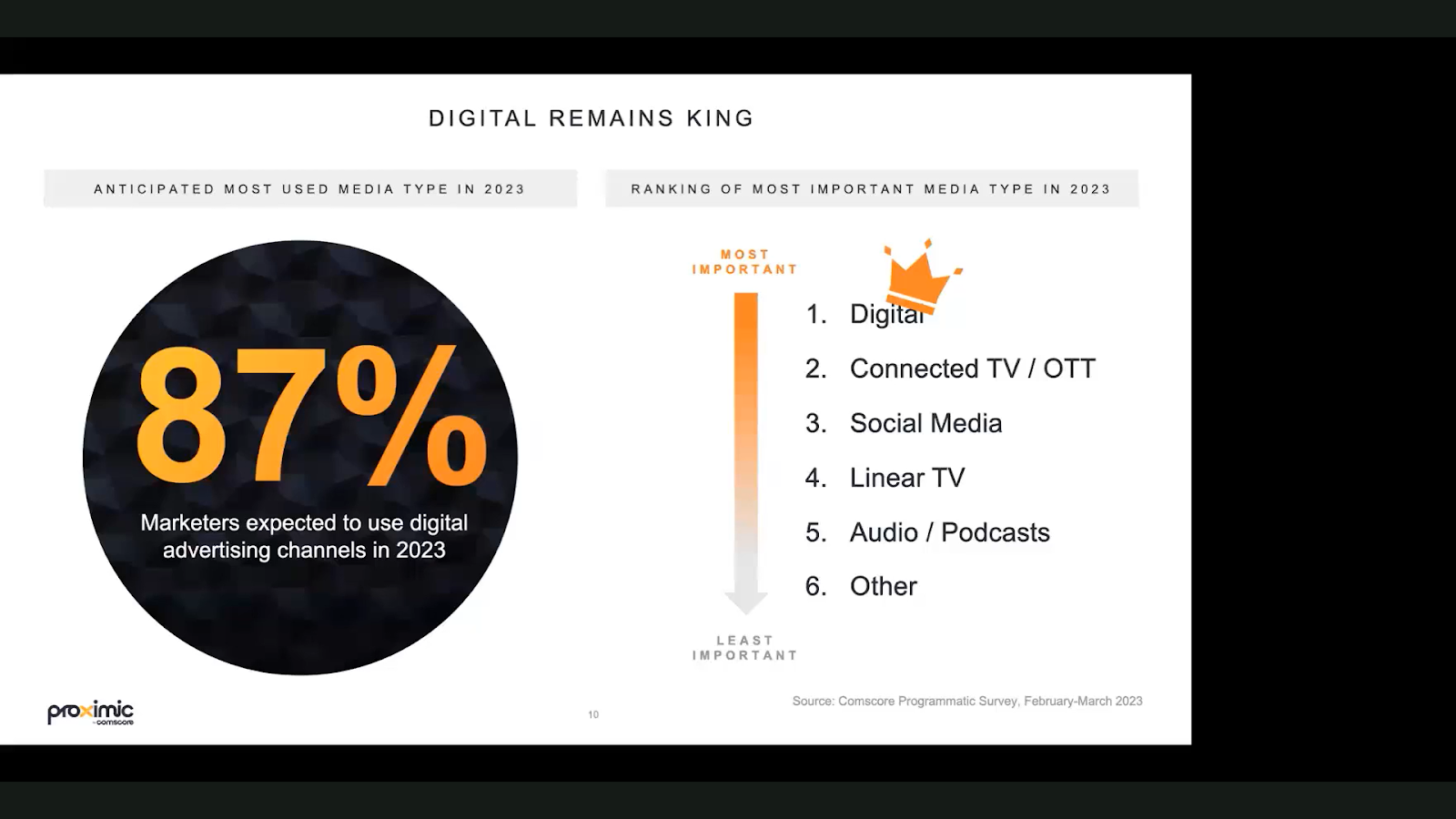

Digital Is King of the Programmatic Court

The agencies surveyed said that marketers would most commonly use digital media channels this year. Eighty seven percent of executives surveyed asserted they would use digital in their media mix. Digital will keep its crown intact.

While headlines proclaim the domination of channels such as CTV and audio, most brands keep it traditional. CTV comes in second in the ranking, but alongside digital, most don’t expect much growth out of these two categories in 2023.

Publishers and advertisers expect podcasts and audio to show significant growth this year. This channel is expected to experience the most significant boost compared to last year, so there is a chance that publishers and advertisers will increase more time and investment in the medium.

Research from this year supports this trend, with a significant number of Americans listening to online audio and podcasts. Brands are relying on digital this year, but it is possible that audio has stock in the game of thrones next year.

Data Investments in the Programmatic Supply Chain Is Mixed

The types of data publishers and advertisers are investing in on the supply chain vary widely based upon what works best for their business and the changing landscape with privacy.

First-Party Data: They expect to allocate a significant portion of their spending towards first-party modeled audiences, emphasizing the value they place on first-party data.

- This data set is vital as brands work toward building audiences without the use of third-party cookies. Google just announced they will go away in the 2nd half of 2024.

Third-Party ID-Based Segments: Third-party ID-based segments are also important, with approximately 43% of the budget allocated to this area. Demographics remain a crucial component of third-party ID-based data.

- 24% of the budget will focus on innovating demographic data

- 19% of this budget will focus on third-party behavioral data. Yet, this data will most likely be a thing of the past after 2024.

Contextual Data: Brands will direct a third of the budget towards idealist contextual segments, which involve traditional contextual topic targeting or newer third-party behavioral, contextual audiences.

- Over half of buyers and sellers expect their use of contextual data to increase this year compared to a mere 3% who indicate that usage will decrease.

The webinar’s moderator explicitly pointed out that this analysis does not consider the cost of each type of data. ID-less contextual data tends to have lower prices compared to ID-based targeting. Contextual targeting represents a smaller portion of the budget. It may result in a higher volume of impressions overall in the campaign delivery.

Privacy Radically Changed Programmatic: “Step Your Cookie-less Game Up”

The consumer data privacy reckoning on the ad tech industry has affected every aspect of the advertising ecosystem, including the programmatic supply chain.

For example, when Apple rolled out its iOS 14.5, it allowed users to block tracking at the app level. The update also required brands to get permission to collect and share consumer data. Based on proximity by comScore data, the implications were that up to 70% of us programmatic mobile ideas vanished overnight.

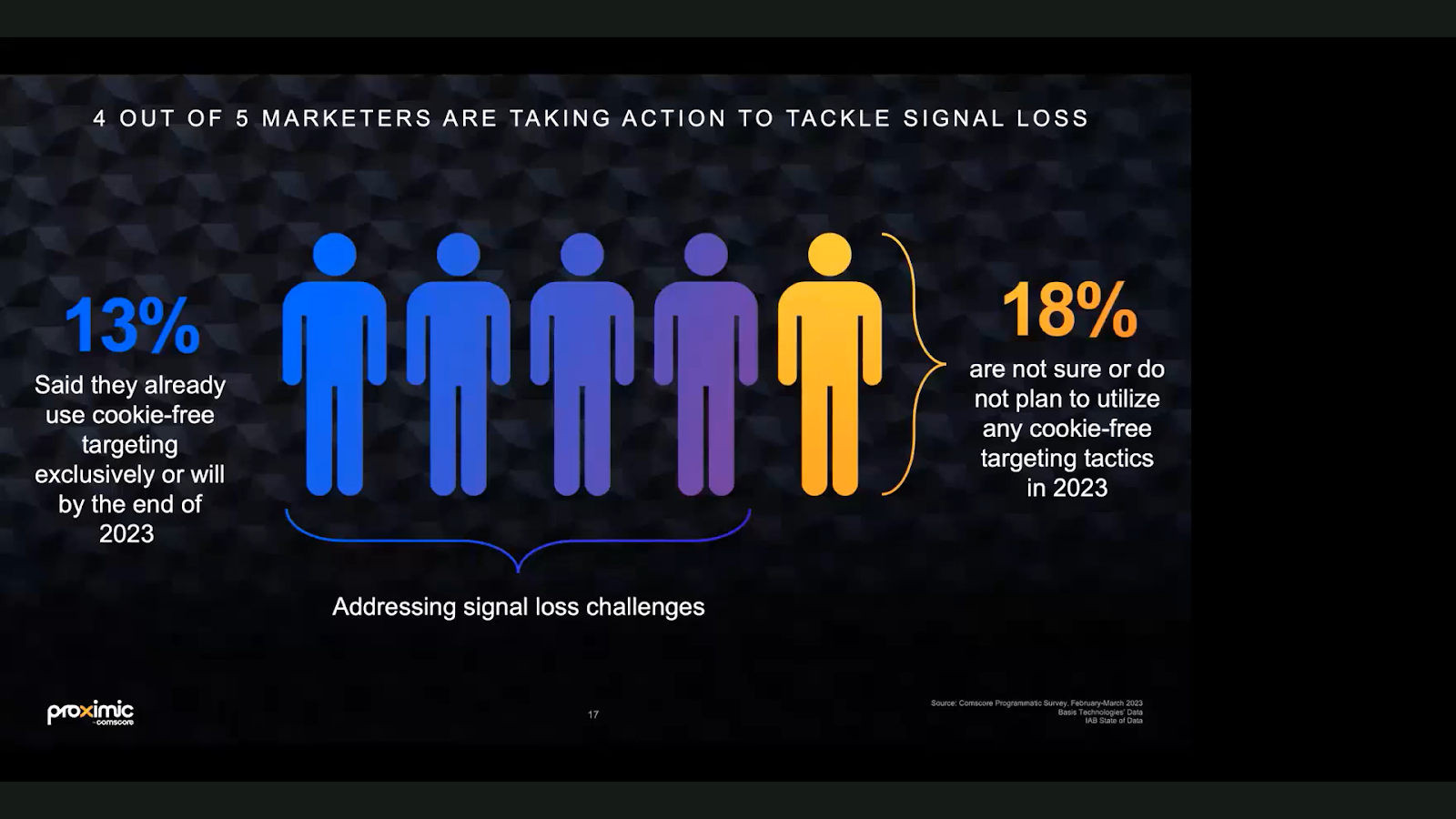

So how are publishers and advertisers dealing with the signal loss?

Many marketers have started to move away from cookie-based targeting. They are represented in the chart by our men in blue. Only 13% of businesses surveyed said they exclusively use cookieless targeting, but many publishers and advertisers have migrated to have cookie-free targeting in their inventory.

For those using the programmatic supply chain, this is the smart move. According to the IAB’s state of data report, 50-60% of programmatic inventory no longer has a User ID.

That 18% represents the man in yellow, you are behind the curve, but you still have a year to “step your cookies up” as Google’s third-party cookie deprecation deadline looms closer. A great place to start testing is on Safari and Firefox have been cookieless for over three years. They hold a significant inventory, about 22% of browser traffic globally.