|

||||||||||||||

|

||||||||||||||

| The DOJ Sues Google (Again). Publishers Respond |

|

| It’s deja vu for Alphabet’s legal team, as the Justice Department once again filed an antitrust lawsuit against the company. This time, the DOJ, joined by eight states, accused the tech behemoth of absolute dominance over the digital ad tech space. In its complaint, the DOJ writes: “But competition in the ad tech space is broken for reasons that were neither accidental nor inevitable. One industry behemoth, Google, has corrupted legitimate competition in the ad tech industry by engaging in a systematic campaign to seize control of the wide swath of high-tech tools used by publishers, advertisers, and brokers to facilitate digital advertising. Having inserted itself into all aspects of the digital advertising marketplace, Google has used anticompetitive, exclusionary, and unlawful means to eliminate or severely diminish any threat to its dominance over digital advertising technologies.” The lawsuit essentially asks Google to pick a side ( buy or sell, but not both). Its request for relief asks that at a minimum, Google should divest itself of the “Google Ad Manager suite, including both Google’s publisher ad server, DFP, and Google’s ad exchange, AdX, along with any additional structural relief as needed to cure any anticompetitive harm.” In the past, Google argued that the digital advertising ecosystem is competitive and crowded and that its competitors — Meta and Amazon — are equally big. According to Reuters, transparency is part of the issue. “Advertisers and website publishers have complained that Google has not been transparent about where ad dollars go, specifically how much goes to publishers and how much to Google.” |

| Most publishers generally agree that Google's dominance forces them to do business with the company, whether they want to or not. For a certain type of publisher — e.g., too big for Google Ad Manager (GAM) but still on the small side — Google's dominance has its benefits. Take Jared Collett, Senior Director of Ad Operations at Major League Fishing. He says using other ad servers is challenging because they either charge too much or have required minimums that exceed his site's needs. "I do not feel obligated to use Google, as I know other options exist. However, I guess you can't call them competitive offerings because of price and versatility. All Google tools I use are "free" except GAM, and all of those tools work together and provide trusted insights and reliable revenue delivery," said Collett. If the DOJ splits up Goole, Major League Fishing could be "negatively impacted in a large way." It's an entirely different matter for larger publishers, such as Red Ventures, which operates many properties, including CNET, Bankrate, Reviews.com, and creditcards.com. According to Terry Guyton-Bradley, Senior Director of Programmatic Advertising Operations, Red Ventures "isn't exactly chained to Google's products," as his company has integrated with other DSPs. That said, 75% of his company's programmatic revenue comes through Google AdX, as this is the only exchange that can provide Red Ventures the scale they need. Another challenge for Guyton-Bradley is that it's difficult to determine if Google is giving Red Ventures a fair price for its inventory. "There is no transparency. Google tells me the CPM I receive, but not what the buyer actually pays Google and what it takes." With no real replacement for Google available, Guyton-Bradely sees a benefit to the DOJ succeeding with its antitrust action. "Alphabet is an unfair monopoly in our industry," he said. In a series of Tweets, CafeMedia's Chief Strategy Officer Paul Bannister speculates what the industry could look like should the DOJ prevail. "Google's publisher business would be forced to compete differently than it does today. It's possible this could open up AdX to run outside of GAM — a prebid adapter might be offered." The sell side would equally benefit:" there would seem to be no reason that DV360 would continue to bias towards AdX. DV would be freed to bid more aggressively into other ad exchanges, which could create real pricing pressure on ad exchange fees, as pricing does drive performance," he wrote. |

| OpenWeb Pumps $100 Million Into Jeeng to Boost Consumer Engagement for Publishers |

|

| OpenWeb broadened its community engagement capabilities with a newfound partnership with Jeeng. Known for working with publishers such as The New York Times, Penske Media, and Forbes, OpenWeb manages comments on articles, data, and polling features on publishers' websites. The firm's tech sorts out toxic data and aggregates the rest to help publishers turn site visitors into subscribers. We all know how important this is for publishers to future-proof their businesses for the post-cookie era. What will Jeeng's technology add to the firm's vision of building the 'OpenWeb Everywhere'? Jeeng uses artificial intelligence to personalize messages to specific consumers based on their content consumption and engagement behaviors. "Publishers can use Jeeng's tools to curate email newsletters, said Nadav Shoval, CEO and co-founder of OpenWeb. "OpenWeb also pushes the data into supply-side platforms to run targeted programmatic ads for advertisers and charges a fee of publishers' ad revenue." Jeeng is the third ad tech company OpenWeb has acquired over the past year. In January 2022, OpenWeb acquired Hive Media for $60 million to build tools for publishers to recommend content better. Afterward, the company acquired Adyoulike for $100 million to expand into social advertising. |

| Consolidation in ad tech is a necessary part of the game, but mergers and acquisitions in the industry severely slowed in 2022. But in 2023, LUMA Partners expects M&A activity to reach pre-Pandemic levels. "Rational valuations should help spur more M&A this year, as businesses are valued based on their sustainability and profit margins rather than purely on growth," Conor McKenna, a director at LUMA Partners recently told AdExchanger. Trending hot topics like data privacy, retail media, podcasting, and CTV will likely boost much of that activity. For example, Israeli-based ad tech vendor, Perion, is looking to invest $400 million in cash in CTV, retail media, and audio acquisitions. "In order to maintain [our] growth, it can be done organically or inorganically through acquisition," CEO, Doron Gerstel recently told Axios. Partnerships like the one between seeming rivals OpenWeb and Jeeng mutually benefit the ad tech vendors. Still, they will also help publishers diversify their revenue streams and prepare for the loss of third-party cookies. The tech partnership will help publishers take the first-party data they acquire through OpenWeb to create deeper engagement with consumers using Jeeng's tools for creating personalized emails, push notifications, and SMS messages — that can all be monetized. "We believe that the only way for publishers to stay relevant and build a healthy business is about building relationships with your customers," says OpenWeb's Shoval. |

| Everything You Need to Know About IAB’s State of Data 2023 |

|

| We will see five new state-level data privacy regulations coming to life in 2023, with a few already brought to life this month. So, it's perfect timing that the IAB unveiled their sixth annual State of Data initiative, IAB State of Data 2023: Data Clean Rooms and the Democratization of Data in the Privacy-Centric Ecosystem this past Tuesday at IAB ALM '23 (and it was one for the books). On behalf of the IAB, Ipsos examined how data clean rooms (DCRs) and privacy-preserving technologies like customer data platforms (CDPs), consent management platforms (CMPs), data management platforms (DMPs), and identity solutions are being commanded and utilized. There are many reasons why DCRs are an essential technology. For one, they enable privacy-compliant data matching and innovative cookie-agnostic measurement capabilities across the buy- and sell-sides. According to the report, by 2023, 80% of advertisers spending more than $1 billion a year on media will use DCRs, but that's not all; here are some other findings:

|

| One major takeaway is that if you want to consider a DCR, weigh the pros and cons of technology implementation and maintenance, and then find the partners that best fit you. The fact that DCR users are likely not leveraging many aspects of advanced measurement represents an opportunity to capitalize on DCR's power and ability to operate in the evolving data landscape. On the flip side, what will it take for DCRs to be a more inclusive solution? As we know, due to cost and other reasons, many smaller advertisers, publishers, and agencies are missing out on benefiting from DCRs’ ability to match user-level data in a privacy compliant way. And then there are the sub-par match rates. Signal loss and state-level privacy legislation present a challenge for match rates, which sets the DCR marketplace back. Some factors contributing to sub-par match rates are identity fragmentation, platform bifurcation, inconsistent data inputs, and data obfuscation. The report also addressed walled gardens and gave them a "this doesn't exclude you nudge" by highlighting that they also need to make their data interoperable for measurement and ROI. DCRs are a worthwhile investment for many, but we hope to see them become more accessible for smaller publishers, brands, and agencies, too, not just the larger ones. We also hope to see the technology progress. "[DCR] is in a nascent stage… it's not a fully matured tech with everything you need [yet]...There is a lot of complexity with volume and types of data, and also organizational structure," said a brand product lead who contributed to the report. |

| Ad Spend 2023: A Rough Start, but There Is Hope Ahead |

|

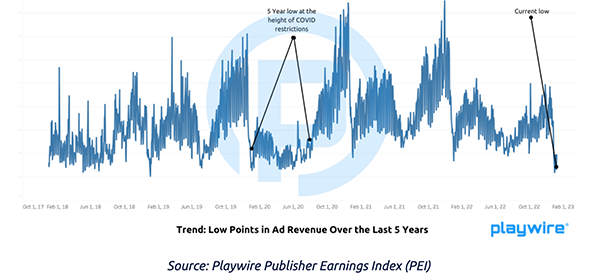

| Publishers and advertisers are waiting with bated breath for 2023’s ad revenue to pick up. With the ad spend slowdown and a possible “ad recession,” last year was tough, but hopefully, 2023 is looking up. Ad revenue across the industry is at a five-year low, with December 2022 ad spend hitting an all-time slowdown period. That month had a 30% lower performance than the previous year and was also lower than December 2020. Yet, December 2020 and 2021 revenue was significantly higher than a typical December, which explains why January 2023 revenue may feel especially low. The industry is currently at the lowest ad revenue earnings of the last five years, which is worse than the height of Covid-related restrictions in the U.S. and on par with the January numbers of 2019. A word of advice: “Buckle up and wait out the storm.” According to Playwire, here is what industry experts assert will happen this year:

|

| This sounds like grim news, but the industry has prepared for this. The ad spend slowdown has affected us for quite some time, and we knew a possible “ad recession” was on the horizon. Publishers need to hammer down on their audience targeting techniques, find ways to experiment with revenue diversification and be open to experimenting with tech and specifications coming out of Prebid and the IAB Tech Lab, like SharedID and Seller Defined Audiences, to future-proof their businesses. We also want to express the need for patience. New techniques will not dig you out of the ad revenue hole right away. Give your new practices some time to bolster up, and industry experts say you will see results toward the end of the year. Overall, publishers expect things to turn around this year, and direct deals, including PMPs and programmatic direct, will likely account for much of that turnaround. |

| Around the Water Cooler |

|

| ICYMI... Rebuild Local News Coalition Forms to Save Local News Local journalism groups representing more than 3,000 local newsrooms have come together to save local news through bipartisan public policy initiatives, with the aim of delivering $3 billion–$5 billion in relief for local news companies. (AXIOS) Breaking up Google's Ad Tech, Won't Stop Its Dominance Even if Big G split up its ad tech businesses, including AdX, GAM, and DV360, it would still dominate search, browser, and consumer data and maintain its upper hand. Yet, it could definitely hurt other parts of its businesses that rely on that data for better targeting. (ADWEEK) Declining Ad Market Continues to Wreak Havoc on Pubs 2022's lackluster ad revenue and bad economy resulted in publishers like CNN, Buzzfeed, and Gannett all making tough decisions to reduce staff. With 2023 ad spend even lower, we're already hearing news that major premium publishers like Dotdash Meredith are also trimming their workforce. Of course, this isn't good news, but it's a trend we hope won't last throughout 2023. (CNN) Slowdown on Social Media Decisions in Florida and Texas As we reported last week, the Supreme Court is considering a reset of Section 230 in light of social media laws coming out of Florida and Texas. But those laws are on hold — potentially for a year — as the Court has asked the Biden Administration to weigh in. (Quartz) Is the Podcast Boom Over? When we talk about the ad spend decline of 2022, we noted that podcasting was one of digital media's bright spots. And while Spotify's recent announcement that it was laying off 6% of its staff might sound just like what every other media and tech company are going through right now, the streamer admits to being overzealous in beefing up its podcast biz. (Morning Brew) |

| @{optoutfooterhtml}@ |