|

||||||||||

|

||||||||||

| The Trade Desk Announces Top 100 List of Publishers of “the Premium Internet” |

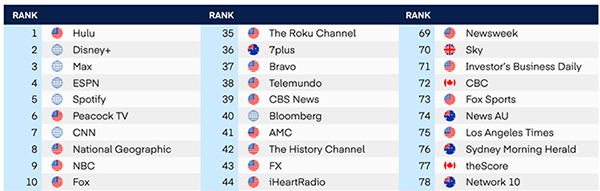

Image sourced from The Trade Desk Sellers and Publishers Report

|

| Last week, The Trade Desk published its biannual Sellers and Publishers Report, which examines the growth drivers of the premium internet (aka the top digital publishers and platforms outside of Google and Facebook). The report notes that we are at an inflection point in the industry: For the first time in a decade, Facebook and Google accounted for less than half of digital ad spending in 2022 and 2023. Consumers now prefer to spend more on premium open internet content, including streaming TV, audio, sports, and journalism. And where consumers go, advertisers follow. But changing consumer behavior tells only part of the story. The report notes that the Walled Gardens are making advertisers nervous, stating, “advertisers are becoming increasingly wary of the limitations and practices of Big Tech walled-garden platforms. Whether it’s the U.S. Department of Justice lawsuit against Google, questions about ad viewability, concerns around the brand safety of user-generated content, or the growing war on journalism by walled gardens — marketers are looking for an alternative. Thus the rise of the premium internet. But who exactly are the entities that make up that illustrious group? The Trade Desk names names, publishing a list of what it deems the Top 100 publishers across all media formats. To rank the publishers, The Trade Desk assessed them according to several criteria, including advertising quality (viewability rates, ads-to-content ratio, refresh rate), reach, and so on. The top destinations include streaming services (Hulu, Disney+), news sites (CNN, NY Times), audio platforms (Spotify), and entertainment properties owned by major media companies. It’s certainly good news that sites outside the walled gardens are getting a bigger slice of the advertiser’s budget, simply publishing the report shows bigger changes afoot in the industry. As AdWeek points out, “Historically, ad tech firms like The Trade Desk have directed brands to the best audiences and not the best publishers. But as third-party cookie deprecation makes it harder to find audiences and quality issues within the internet become more apparent, that paradigm is changing.” One can’t help from wondering, will there be a role for SSPs in the new paradigm? - SS |

| OpenAI Signs Deals with The Atlantic and Vox Media |

| Remember how Mark Zuckerberg wanted to buy Simon & Schuster so Meta could train its AI on long-form content? Every AI company is on a quest for data for the obvious reason that the more data, the better the model. That’s why it’s a big deal that OpenAI was able to sign deals with The Atlantic and Vox Media right on the heels of announcing a big partnership with Dotdash Meredith. As Axios noted, “The deals give OpenAI added momentum in its quest for credible content to train its algorithms and inform its chatbots — and could also protect the Microsoft-backed company further from future copyright liability.” The agreement allows OpenAI to license current and archived content of both houses to train its AI models. In return, OpenAI promises to cite their work (a sticking point for many publishers, including the New York Times, which is suing OpenAI for copyright infringement). For The Atlantic and Vox Media, the deal is sweetened in important ways. The Atlantic, for instance, can use OpenAI products for its Atlantic Labs initiative. Meanwhile, Vox plans to use OpenAI for a range of internal and audience-facing use cases, as well as for its first-party data platform. - SS |

| Sitting on a Trove of Data, PayPal Launches Ad Platform |

| Perhaps as a surprise to exactly no one, PayPal has announced it’s getting into the advertising game. Recently hired Mark Grether and John Anderson will lead the company’s development of an advertising platform called PayPal Ads. The platform will let brands and merchants target shoppers, as well as its 400 million PayPal and Venmo users with personalized ads and offers based on their purchase data and spending patterns. This past January, PayPal launched Advanced Offers, an AI-fueled platform that lets merchants target PayPal users with discounts whenever they go to make a purchase. Now PayPal wants to take its advertising further, letting merchants that don’t use its payment products target shoppers. “Those companies might use PayPal data to target consumers with ads that could be displayed elsewhere, for instance, on other websites or connected TV sets,” The Wall Street Journal writes. As a shopper who uses digital wallets to pay for stuff, you may wonder about your privacy. As a user, your data will automatically be included in the new network, although PayPay says you’ll have a chance to opt-out. Even if some smattering of users figure out how to opt-out, PayPal has one of the biggest customer bases in the world. It seems inevitable that it will dominate the retail media. - SS |

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

| @{optoutfooterhtml}@ |